Sponsored – Est. Read 7 Min

6 Key Reasons

Why MedBright AI (CSE: MBAI); (OTCQB: MBAIF) Should Be on Your Radar Right Now

01

MedBright AI’s proprietary technology has the potential to fundamentally disrupt the way healthcare clinics are run. Yet unlike many other AI startups, which are only available to insiders and institutions, MedBright AI offers individual investors a unique chance to invest on the ground floor of a potentially game-changing AI technology.

02

MedMatrix is Helping Solve the $200 Billion Healthcare Waiting Room Problem

Backed-up waiting rooms – and long wait times – at healthcare clinics frustrate patients and cause physician burnout. By replacing the current ‘70s-era system of resource allocation with AI-driven technology, great efficiency can be realized. MedBright AI’s flagship product, MedMatrix, allows clinics to better predict patient needs and prioritize resources…leading to higher patient satisfaction and improved clinic revenue.

03

MedBright AI Enjoys a Critical First Mover Advantage in a Massive Market

MedBright AI’s MedMatrix is truly ahead of its time, as it employs proprietary technology and attacks the healthcare clinic efficiency problem in a new way. More importantly, the company has a two-year head start on any potential industry competition…an edge that is truly massive in such a rapidly-growing space. And it also puts MedMatrix in position to become the most widely adopted scheduling tool in all of U.S. healthcare.

MedBright AI recently completed the beta phase for MedMatrix and is now moving toward the revenue generation phase of its MedMatrix product. During the beta phase, the company identified five features as high value tools for outpatient clinics based on their ability to generate revenue for those clinics.

05

Unique Business Model Offers Rapid Rollout and High Margin Potential

By offering a solution requiring no training and no upfront costs to clinics, Medbright AI has the potential to quickly grow its base of clinic revenues. The company, in just six weeks’ time, already has 14 clinics under contract – totaling an estimated $100 million of clinic revenue – and climbing. And this is a business that comes with extremely attractive profit margins…as high as 80%.

Relationships with World-Class Healthcare Clinic Groups, Including Yale School of Medicine

MedBright AI’s relationships with world-class healthcare clinic groups include a contract with CareMEDICA, a leading clinic group affiliated with the Yale University School of Medicine. In addition, the company’s leadership team includes doctors affiliated with both Yale Medical School and UCLA Medical Center. These affiliations offer important validation of this under-the-radar company’s vast potential.

MedBright AI’s Proprietary AI Technology Stands Poised to Solve the $200 Billion Waiting Room Problem

Over the past year, the emergence of artificial intelligence (AI) has been one of the world’s most important developments.

“One of the hottest investment trends on Wall Street (is) AI stocks. Investors and analysts are recognizing the long-term value potential of artificial intelligence, especially after OpenAI chatbot ChatGPT took the world by storm.”

The rapid growth of AI technology has triggered a number of opportunities for investors, including companies like…

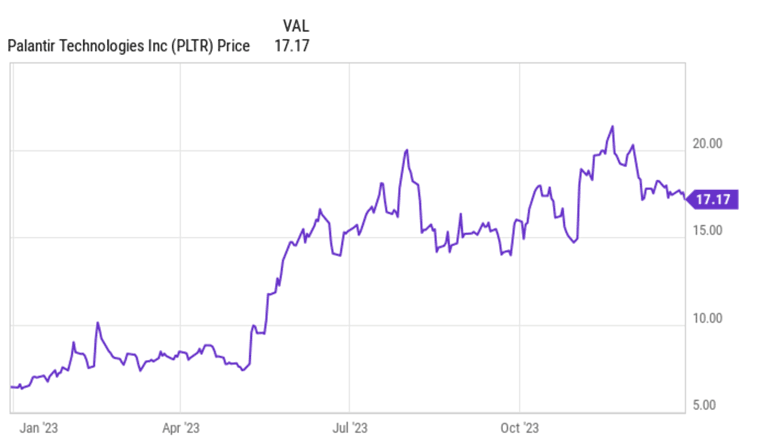

- C3.AI Inc. (NYSE: AI), which gained 151.18%[i] in 2023…

- Palantir Technologies, Inc. (NYSE: PLTR) which produced 94% gains[ii] in 2023…

- And NVIDIA Corp. (NYSE: NVDA), which delivered 46% gains[iii] for investors in 2023.

AI + 151.18%

As this new technology continues to evolve – and as more industries are radically changed by its application – new opportunities are emerging for investors with the potential for similar success.

One of the most intriguing AI opportunities right now appears to be in the healthcare space. This is happening as one forward-thinking company is applying its own proprietary AI technology to solve a $200 billion problem facing healthcare clinics.

That company is MedBright AI (CSE: MBAI); (OTCQB: MBAIF), an investment issuer focused on investing in healthcare technology companies that are changing how care is delivered.

How MedBright AI is Changing the

Game for Healthcare Clinics

Thanks to its proprietary AI technology, MedBright AI is solving a massive, $200 billion problem that has consistently frustrated both doctors and patients:

The waiting room problem.

If you’ve been to a healthcare clinic or a doctor’s office, then you likely have first-hand experience with this problem.

Waiting rooms are filled. Doctors have limited time. Wait times are beyond excessive. And the problem continues to get worse.

There’s a reason for this: As the population continues to trend toward a more advanced age, more and more healthcare visits are required.

But the system being used for matching patients in need of care with the resources to access that care is stuck in the 1970s.

Again, you’re likely already familiar with this…as patients are usually assigned a standard 20-minute time slot on a first-come, first-served basis.

This system of resource allocation is woefully outdated and does not take into consideration a patient’s unique medical and time needs on a case-by-case basis.

That’s where AI technology is poised to play a huge role.

“Gen AI represents a meaningful new tool that can help unlock a piece of the unrealized $1 trillion of improvement potential present in the (healthcare) industry.”

More specifically, that’s where MedBright AI believes that artificial intelligence has the potential to drastically improve patient and physician experience in a powerful way.

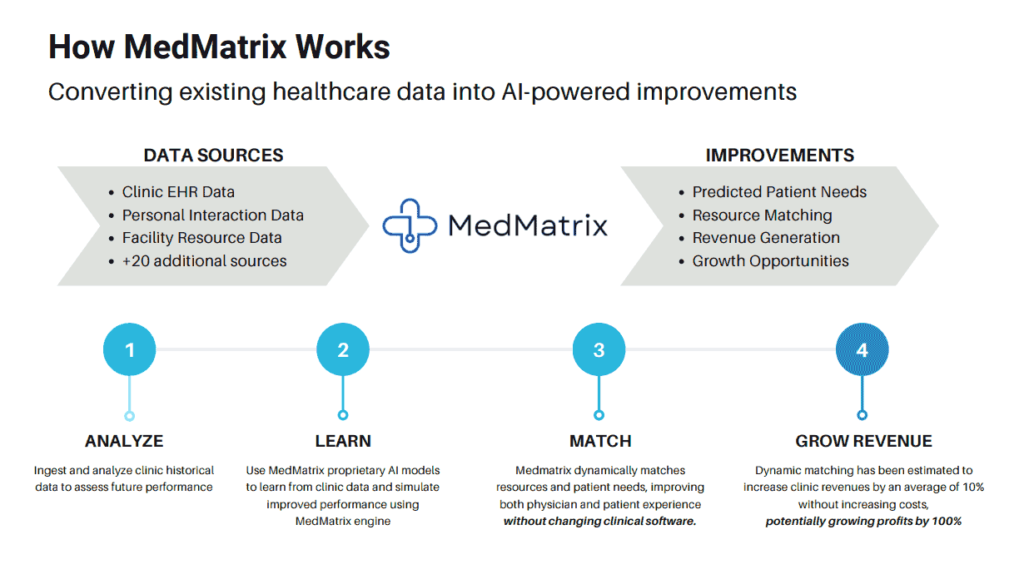

MedBright AI (CSE: MBAI); (OTCQB: MBAIF) has invested in several companies working to solve the healthcare waiting room problem. These companies have collaborated to create MedBright AI’s flagship product, known as MedMatrix.

In fact, thanks to the proprietary AI technology powering MedMatrix, the company – in just a few months’ time – has already begun to…

- Provide game-changing optimization for its partner clinics…

- Allow doctors and patients to avoid frustration and burnout…

- And allow those clinics to operate at much higher efficiency and increase their revenue.

Simply put, MedMatrix is an AI-powered data analytics platform and engine that helps doctors find hidden value in their clinics and improve both patient and physician satisfaction.

MedMatrix helps better align the resources of clinics with the needs of patients in a way that helps improve the physician’s bottom line.

MedMatrix harnesses the power of artificial intelligence to evaluate and analyze key aspects of healthcare facilities, including patient needs, provider & resource matching and optimization, revenue cycle management, market competition and expansion, and patient revenue enhancement opportunities.

Through its advanced AI and data analytics capabilities, MedMatrix supports healthcare professionals to optimize each of these critical areas to capture revenue and efficiency opportunities:

- AI Reporter – provides data reporting from the MedMatrix AI analytics platform, a complete dashboard of a clinic’s operations, and the MedMatrix forecaster, which allows customers to see how changes to the clinic’s resource matching, revenue models, and market locations and competition could improve business operations.

- AI Market Expander – analyzes providers’ current clinic locations and allows them to assess the potential demand in the market based on patient demographics, competition, facility costs, and other key factors. Providers can simulate facility moves or expansion of additional clinics to predict the impact on their top and bottom line. The Market Expander also includes the ability to identify top candidates for conversion into the clinic based on their demographics and preferences.

- AI Resource Matcher – acts as a virtual assistant to front office administration, analyzing patient needs at the time of scheduling and matching them to the appropriate resource within the clinic. The Resource Matcher can dynamically assign appointment durations and times based on need, while helping predict late or no-show patients to improve clinic on-time performance and overall efficiency.

- AI Claim Optimizer – analyzes a clinic’s claim data to look at key performance indicators for revenue cycle management and analyzes top reasons for claim denials and areas for improvement in coding, charge capture, claim processing, and RCM workflows.

- AI Revenue Enhancer – finds opportunities for revenue growth based on a clinic’s existing patient base and revenue models. These can include identification of patient upsell opportunities for non-medical procedures, patient clinical trial recruitment, concierge medicine upsell opportunities, and other revenue generating products and services.

These five features have been identified as high value tools for outpatient clinics. As a next step, MedMatrix plans to unveil its revenue generating go-to-market strategy as it transitions current beta customers to commercial agreements.

BREAKING NEWS

MedMatrix Product Moves from Beta to Full Commercialization, Announces AI Product Suite

On February 27, MedBright AI Investments Inc. announced that MedMatrix, a product in which it has a significant investment, has completed its beta testing with its initial clients. As a result of the beta testing period, management has chosen a five-feature product suite to sell into the global outpatient facility market.

For Investors, MedBright AI Offers a Unique First-Mover Advantage in a Massive Potential Market

So how is MedBright AI (CSE: MBAI); (OTCQB: MBAIF) working to monetize the AI technology platform that they’ve built with MedMatrix?

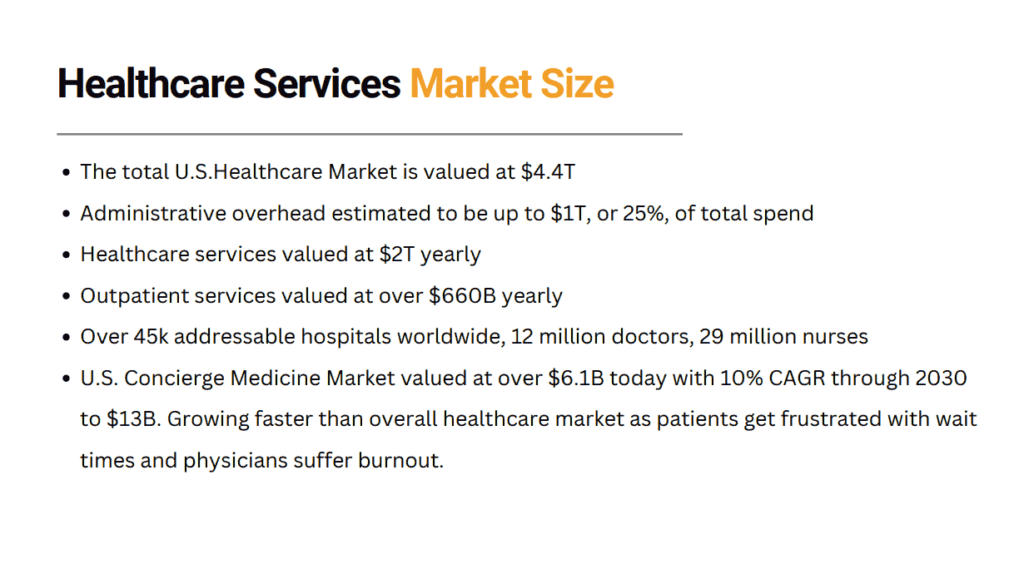

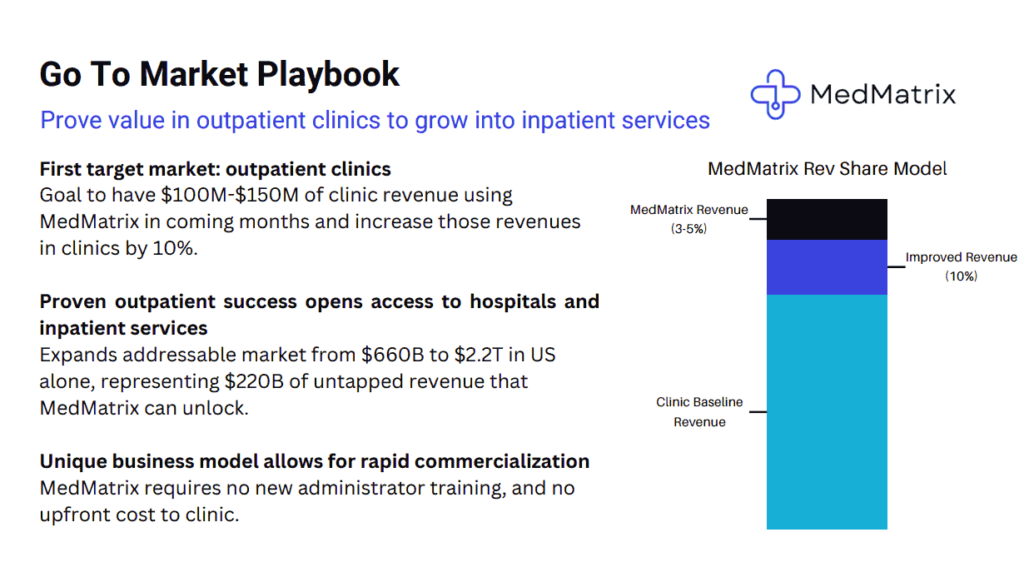

First, the company is targeting 1% penetration into the healthcare services outpatient market in the next 24 months.

Of course, the healthcare services market is truly massive, valued at $2.2 trillion. So MedBright AI’s stated target of creating a 10% improvement in that market represents a $220 billion opportunity for the company.

MedBright AI’s initial goal was to have $100 to $150 million worth of clinic revenue on the books through its clinic partnerships within its first few months of rollout.

That initial goal will need to be revised upward, however, as in just six weeks’ time the company has reached $100 million in revenue through 14 clinic partnerships in a market that is notoriously slow to adopt new products.

MedBright AI’s business model is unique in that the company has already built its powerful, AI-driven platform. This means no additional significant development or resource costs are required.

The company’s rollout consists of applying its AI-powered model to a healthcare clinic’s existing data from the past 2-3 years and demonstrating how the clinic could increase its revenue and efficiency by an average of 10%.

This 10% improvement in revenue is especially attractive to clinics because most operate on margins of 5% to 10%…meaning that applying the MedMatrix AI-driven technology to their business could potentially result in doubling their margins.

This business model is also attractive in that the clinic is not required to pay any up-front costs to MedBright AI…no expensive software needs to be purchased…and no intensive training of staff is required.

Instead, agreements call for MedBright AI (CSE: MBAI); (OTCQB: MBAIF) to simply receive a percentage of the increase in revenue achieved by the new, more efficient scheduling and resource allocation.

Major Players Are Looking to Seize Investment Opportunities in the Healthcare Clinic Space…What Could This Mean for MedBright AI (CSE: MBAI); (OTCQB: MBAIF)

Over the past two years, many larger healthcare companies have made huge acquisitions to gain exposure in the rapidly growing healthcare clinic space.

This includes major acquisitions like…

Given the rapid start by MedBright AI (CSE: MBAI); (OTCQB: MBAIF) – with $100 million in revenue commitments and counting – along with the company’s significant first-mover advantage, a potential acquisition bid from a larger company would not be surprising.

As of this writing, the company’s market cap is around just US$20 million. With the revenue scenario that is now unfolding – and the company’s projected high margins – the potential also exists for signification adjustment in valuation by the market.

The ground-floor opportunity for investors to stake their claim in MedBright AI may not be available for long…that’s why it’s critically important that investors take time now to perform their own due diligence and consider the opportunity for investment.

MedBright AI’s Leadership Team is Highly Experienced…and Exceptionally Well-Connected

One of the more impressive aspects of MedBright AI (CSE: MBAI); (OTCQB: MBAIF) is the company’s highly experienced leadership team.

MedBright AI’s investment committee encompasses decades of experience in healthcare, technology and investing.

The committee is chaired by Michael Dalsin, an investment expert with over 25 years of experience specializing in healthcare products, technology and services. Mr. Dalsin was Chairman of Patient Home Monitoring – a company which grew from $.06 per share to $2.50 before eventually becoming two Nasdaq companies: VieMed Healthcare Inc. (NASDAQ:VMD), and Quipt Home Medical (NASDAQ:QIPT).

And MedBright AI’s team of management and directors includes doctors with long-standing affiliations with UCLA Medical Center and Yale Medical School. This connection to world-leading clinic groups provides the company with critical validation of their platform as they roll out to new clinics throughout North America.

The MedBright AI leadership team includes…

Trevor Vieweg, CEO & Investment Committee Board Member, is a co-founder of Limmi, an AI platform focused on powering the world’s most complex healthcare data analytics systems. He previously served as the Chief Technology Officer of Sea Machines Robotics, a venture backed robotics start-up, as well as Head of Product Development at Viasat (NASDAQ:VSAT). He holds a bachelor’s degree in mechanical & aerospace engineering from Cornell University and a master’s degree in enterprise software architecture from the University of California San Diego.

Dr. Jaime Gerber, MD, FACC, RPVI, Chairman of the Board, is a cardiologist specializing in preventive cardiology, as well as complex cardiology cases that involve coronary artery disease, peripheral artery disease, and risk factor modification. Additionally, Dr. Gerber is a Professor of Medicine at Yale Medical School, is the co-director of the Yale Executive Health program, and directs the Yale New Haven Heart & Vascular Center laboratory for vascular ultrasound testing for peripheral arterial disease. He has broad experience in medical systems management and healthcare start-ups.

Michael Dalsin, Chairman of Investment Committee is an investment expert with over 25 years experience specializing in healthcare products, technology and services. Mr. Dalsin was Chairman of Patient Home Monitoring, which has now become two Nasdaq companies: VieMed Healthcare Inc. (NASDAQ:VMD), and Quipt Home Medical (NASDAQ:QIPT). He was the founder and Industry Advisor to The Healthcare Special Opportunity Fund, a listed Canadian company. He has been asked to be a recurring guest lecturer at Yale University Medical School on the topic of fund flows and capital in the global healthcare economy.

Dr. Konita Wilks, DDS, Director, applies mission-driven, strategic thinking to improve hospital operations and patient outcomes as the CEO of Olive View-UCLA Medical Center in Los Angeles, CA, a 355-bed general acute care hospital that employs nearly 5500 persons and has a $900-million dollar annual operating budget. She has over 25 years of experience as a dynamic, visionary leader in healthcare and the military. Prior to her role as CEO, she served as the Medical Director of Quality and Patient Safety Officer and Chief of Dental Services for Los Angeles County Health Services. Dr. Wilks is a U.S. Naval Academy graduate, naval officer, and combat veteran who fought in support of Operation Iraqi Freedom and Enduring Freedom in the Persian Gulf. She received her doctorate from the UCLA School of Dentistry.

6 Key Reasons

Why MedBright AI (CSE: MBAI); (OTCQB: MBAIF) Should Be on Your Radar Right Now

01

MedBright AI’s proprietary technology has the potential to fundamentally disrupt the way healthcare clinics are run. Yet unlike many other AI startups, which are only available to insiders and institutions, MedBright AI offers individual investors a unique chance to invest on the ground floor of a potentially game-changing AI technology.

02

MedMatrix is Helping Solve the $200 Billion Healthcare Waiting Room Problem

Backed-up waiting rooms – and long wait times – at healthcare clinics frustrate patients and cause physician burnout. By replacing the current ‘70s-era system of resource allocation with AI-driven technology, great efficiency can be realized. MedBright AI’s flagship product, MedMatrix, allows clinics to better predict patient needs and prioritize resources…leading to higher patient satisfaction and improved clinic revenue.

03

MedBright AI Enjoys a Critical First Mover Advantage in a Massive Market

MedBright AI’s MedMatrix is truly ahead of its time, as it employs proprietary technology and attacks the healthcare clinic efficiency problem in a new way. More importantly, the company has a two-year head start on any potential industry competition…an edge that is truly massive in such a rapidly-growing space. And it also puts MedMatrix in position to become the most widely adopted scheduling tool in all of U.S. healthcare.

04

MedBright AI recently completed the beta phase for MedMatrix and is now moving toward the revenue generation phase of its MedMatrix product. During the beta phase, the company identified five features as high value tools for outpatient clinics based on their ability to generate revenue for those clinics.

Unique Business Model Offers Rapid Rollout and High Margin Potential

By offering a solution requiring no training and no upfront costs to clinics, Medbright AI has the potential to quickly grow its base of clinic revenues. The company, in just six weeks’ time, already has 14 clinics under contract – totaling an estimated $100 million of clinic revenue – and climbing. And this is a business that comes with extremely attractive profit margins…as high as 80%.

Relationships with World-Class Healthcare Clinic Groups, Including Yale School of Medicine

MedBright AI’s relationships with world-class healthcare clinic groups include a contract with CareMEDICA, a leading clinic group affiliated with the Yale University School of Medicine. In addition, the company’s leadership team includes doctors affiliated with both Yale Medical School and UCLA Medical Center. These affiliations offer important validation of this under-the-radar company’s vast potential.

[i] https://www.usatoday.com/money/blueprint/investing/best-ai-stocks/

[ii] C3ai, Inc. (NYSE: AI) opened at $11.43 on 1/3/23 and closed at $28.71 on 12/29/23

[iii] Palantir Technologies, Inc. (NYSE: PLTR) opened at $6.58 on 1/3/23 and closed at $17.17 on 12/29/23

[iv] NVIDIA Corp. (Nasdaq: NVDA) opened at $148.51 on 1/3/23 and closed at $495.22 on 12/29/23

[v] https://www.forbes.com/sites/bernardmarr/2023/10/03/the-10-biggest-trends-revolutionizing-healthcare-in-2024/?sh=54a810811d13

[vi] https://www.mckinsey.com/industries/healthcare/our-insights/tackling-healthcares-biggest-burdens-with-generative-ai

Disclaimer:

This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. WallStreetNation.com, owned and operated by Jade Cabbage Media, LLC d/b/a STOXmedia.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold, or held by viewers that learn of the profiled companies through our website. Please review all investment decisions with a licensed investment advisor.

This Advertorial was paid for in an effort to enhance public awareness of the issuer, MedBright AI Investments Inc and its securities. Jade Cabbage Media, LLC d/b/a STOXmedia.com has received up to ten thousand USD dollars by Winning Media LLC as a total production budget for this advertising effort. Neither WallStreetNation.com, Winning Media LLC or Jade Cabbage Media LLC currently hold the securities of the issuer, MedBright AI Investments Inc and do not currently intend to purchase such securities.

The issuer, MedBright AI Investments Inc. has compensated Winning Media LLC the sum total of fifty thousand dollars USD total production budget to manage a digital media campaign for thirty days (1-18-24 to 2-17-24).

This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are several important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues, and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur.

More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. Jade Cabbage Media, LLC d/b/a STOXmedia.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.